Page 17 - Two_Rivers_Accountantcy_(W-1198041)_BR[fb]_A21

P. 17

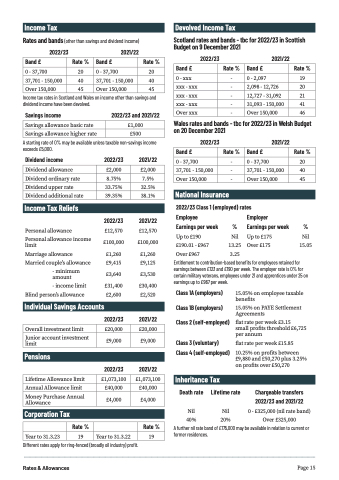

Income Tax

Rates and bands (other than savings and dividend income)

Devolved Income Tax

Scotland rates and bands - tbc for 2022/23 in Scottish Budget on 9 December 2021

2022/23 Band £

0 - 37,700

37,701 - 150,000

Over 150,000

Rate %

20

40

45

2021/22

37,701 - 150,000

Over 150,000

2022/23

2021/22

2,098 - 12,726

12,727 - 31,092

31,093 - 150,000

Over 150,000

Band £

0 - 37,700

Rate %

20

40

45

Band £

0-xxx xxx - xxx

xxx - xxx

xxx - xxx

Over xxx

Rate %

- -

-

-

-

Band £

0 - 2,097

Rate %

19

20

21

41

46

Income tax rates in Scotland and Wales on income other than savings and dividend income have been devolved.

Savings income

Savings allowance basic rate

Savings allowance higher rate

2022/23 and 2021/22

£1,000

£500

Wales rates and bands - tbc for 2022/23 in Welsh Budget on 20 December 2021

A starting rate of 0% may be available unless taxable non-savings income exceeds £5,000.

2022/23

2021/22

37,701 - 150,000

Over 150,000

Dividend income

Dividend allowance Dividend ordinary rate Dividend upper rate Dividend additional rate

Income Tax Reliefs

Personal allowance

Personal allowance income limit

Marriage allowance Married couple’s allowance

- minimum amount

- income limit Blind person’s allowance

Individual Savings Accounts

Overall investment limit

Junior account investment limit

Pensions

Lifetime Allowance limit

Annual Allowance limit

Money Purchase Annual Allowance

Rate %

20

40

45

%

Nil 15.05

Entitlement to contribution-based benefits for employees retained for earnings between £123 and £190 per week. The employer rate is 0% for certain military veterans, employees under 21 and apprentices under 25 on earnings up to £967 per week.

2022/23 2021/22

£2,000 £2,000 8.75% 7.5% 33.75% 32.5% 39.35% 38.1%

2022/23 2021/22

£12,570 £12,570

£100,000 £100,000

£1,260 £1,260 £9,415 £9,125

£3,640 £3,530

£31,400 £30,400 £2,600 £2,520

2022/23 2021/22

£20,000 £20,000

£9,000 £9,000

2022/23 2021/22

£1,073,100 £1,073,100

0-37,700 -

37,701 - 150,000 -

Over 150,000 -

National Insurance

Band £

Rate %

Band £

0-37,700

2022/23 Class 1 (employed) rates

Employee

Earnings per week

Up to £190

£190.01 - £967

Over £967 3.25

Class 1A (employers) Class 1B (employers) Class 2 (self-employed)

Class 3 (voluntary) Class 4 (self-employed)

Inheritance Tax

15.05% on employee taxable benefits

15.05% on PAYE Settlement Agreements

flat rate per week £3.15

small profits threshold £6,725 per annum

flat rate per week £15.85

10.25% on profits between £9,880 and £50,270 plus 3.25% on profits over £50,270

Employer

% Earnings per week

Nil Up to £175 13.25 Over £175

Corporation Tax

Year to 31.3.23

Rate %

19

£40,000

£4,000

Year to 31.3.22

£40,000

£4,000

Rate %

19

Death rate

Nil 40%

Lifetime rate

Nil 20%

Chargeable transfers

2022/23 and 2021/22

0 - £325,000 (nil rate band) Over £325,000

Different rates apply for ring-fenced (broadly oil industry) profit.

A further nil rate band of £175,000 may be available in relation to current or former residences.

Rates & Allowances

Page 15